OpenBank US – Launching a Digital Bank

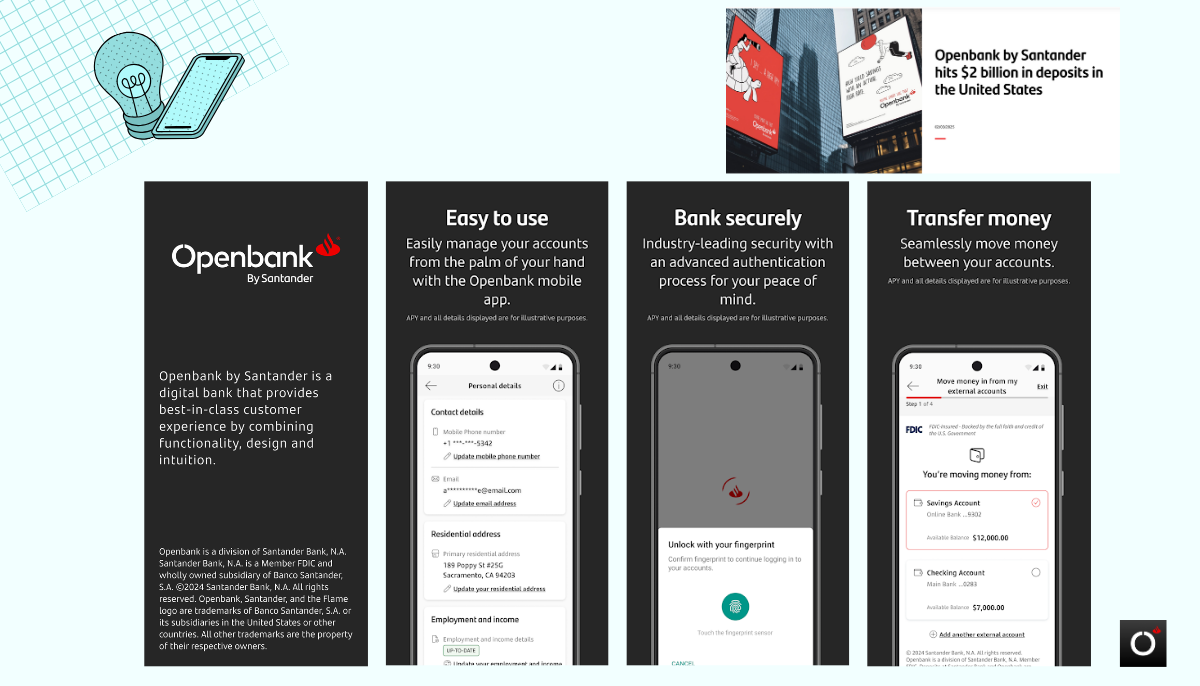

Captured $2B in deposits. Built a modern banking platform on legacy infrastructure. Lessons in speed, scale, and strategic trade-offs.

Overview

OpenBank US was one of the most ambitious digital banking launches in the U.S. market.

Within five months, we surpassed $2B in deposits by building a product that blended high-yield savings, embedded lending, and smart payment choices — all wrapped in a modern digital experience.

This wasn't just a launch. It was a blueprint for how to move fast inside a legacy institution.

My Role

As part of the three-person C-level strategy team, I led key product, partnership, and payment workstreams:

- Product Strategy: Defined the MVP experience, led the banking charter evaluation, and shaped the go-to-market roadmap.

- Payments Infrastructure: Took on the Head of Payments Transformation role to build a unified, configurable payment experience with ACH, digital wires, and authentication layers.

- Core Banking System RFP: Ran the core banking system selection process, evaluating legacy vs. cloud-native solutions and advising on long-term scalability trade-offs.

- Embedded Finance Design: Structured the link between savings and Santander's auto lending unit, enabling OpenBank to become a smart deposit funnel.

Key Contributions and Wins

- $2B in deposits captured in five months, doubling early growth targets.

- Avoided regulatory delays by advocating for use of Santander's existing charter, accelerating launch readiness.

- Modernized payment experience, integrating third party vendors and enabling customer choice on transaction speed and cost.

- Influenced core tech decisions , pushing for cloud migration to enable future innovation.

- Created high-yield incentive loops , driving adoption of savings products tied to future lending capability.

Challenges and Solutions

- Decision Paralysis on Charter: Resolved internal debates on whether to apply for a new charter or use existing licensing. I aligned stakeholders by outlining the operational and risk benefits of a shortcut using Santander's framework.

- Legacy Core Infrastructure: Santander's core was not cloud-native. I ran the RFP and influenced a compromise: launch fast on legacy, while investing in parallel cloud modernization.

- Compressed Timeline: We made hard trade-offs on feature scope to meet launch deadlines. For example, instead of building a U.S.-native payments stack from scratch, we localized Santander EU modules and layered U.S.-compliant controls.

What I Learned

- Launch speed comes from constraint, not chaos. Clarity on what to cut is just as important as what to build.

- Legacy systems can slow you down, but smart architecture buys time. The real challenge is balancing long-term tech debt with short-term market capture.

- A "global bank" strategy rarely works without local intuition. U.S. customers needed a more tailored, personalized banking flow than what worked in Spain or Germany.

Conclusion

OpenBank US proved that with the right strategic alignment and execution muscle, a legacy institution can launch a high-growth digital bank in months, not years.

It was a masterclass in trade-offs: Speed vs. completeness. Flexibility vs. control. Global brand vs. local product.

The $2B in deposits was only the beginning. This project cemented how I approach every 0-to-1 challenge today, by starting fast, simplifying complexity, and building with urgency and intention.

Like what you see? Let's build something that moves the needle.

Contact Me