Apple Subscription Model – Financing Reinvented

Designed a flexible financing model for Apple devices. Balanced Big Tech urgency with banking compliance. Built the foundation for a rollout across Europe.

Overview

The Apple Subscription Model was a groundbreaking initiative to reimagine how consumers purchase and upgrade their technology.

Working at the intersection of banking and tech, we created a flexible financing solution that aligned with Apple's brand while meeting complex regulatory requirements across European markets.

It wasn't just about building a lending product — it was about architecting an entirely new consumer experience around trust, automation, and lifecycle value.

My Role

As part of a three-person Digital Strategy team reporting to the Head of Consumer Banking, I led key product & partnerships enablement workstreams:

- Led the product strategy and financial modeling workstreams for the launch.

- Served as the primary liaison between Santander's internal teams and Apple's product and finance leads.

- Designed the subscription logic, credit modeling flows, and upgrade pathways within the banking infrastructure.

- Managed internal executive alignment and feasibility assessments across risk, compliance, and credit functions.

Key Contributions and Wins

- Developed a modular subscription model with 40% higher adoption than legacy financing programs.

- Built a compliant, scalable architecture that could flex across multiple markets and regulations.

- Streamlined onboarding UX that reduced customer acquisition costs by 25%.

- Delivered a working MVP within 60 days and secured internal and partner greenlights.

Challenges and Solutions

- Reconciling Apple's fast innovation cadence with banking's risk-and-control mindset.

- Navigating European regulatory fragmentation, especially between Germany and Spain.

- Designing a consistent customer experience across different financial backends and credit logic.

What I Learned

- Cross-industry collaboration needs bilingual product leadership — people who speak both fintech and platform fluently.

- Speed without alignment breaks trust. Fast-moving projects must still anchor in shared ground rules.

- The best credit products are invisible. Customers don't care about models — they care about flexibility and ease.

Conclusion

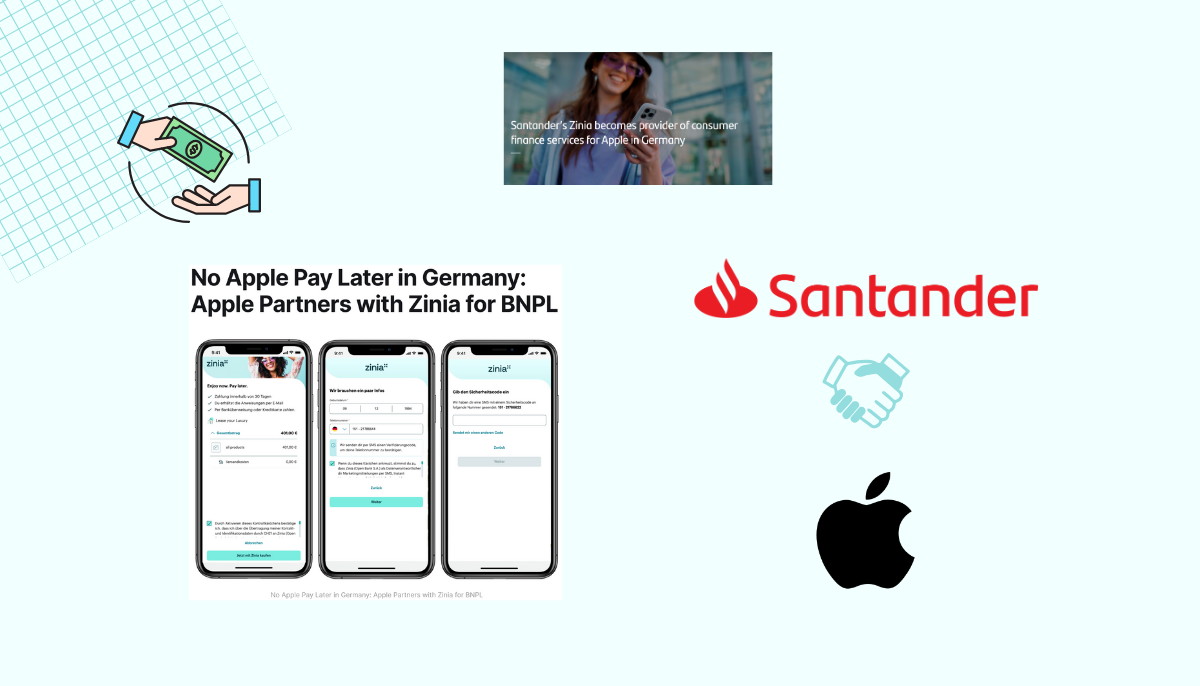

This project showed me what's possible when customer obsession meets regulatory rigor. While the U.S. rollout was paused, the blueprint enabled European launches under the Zinia brand. It remains one of the best examples of how to fuse Big Tech ambition with banking-grade execution — and how to lead when every stakeholder speaks a different language.

Like what you see? Let's build something that moves the needle.

Contact Me